Miami has been named the top U.S. real estate market for ultra-rich foreign buyers of luxury real estate. According to the US Ultra Prime Real Estate Report, 26% of American ultra-luxury properties sold to overseas buyers were in Miami, with over 95% of the deals being completed in cash.

Read More9501 Collins Avenue Ocean 7 Townhouse 7, Surfside | TOUR HERE

Douglas Elliman Releases Q3 2017 Market Report, South Florida Markets Show Slight Stall After Hurricane Irma

Douglas Elliman has released their Q3 2017 South Florida Market Reports for Miami Mainland, Miami Beach, Boca Raton, Fort Lauderdale, Palm Beach, Wellington, Delray, and Jupiter/Palm Beach Gardens. The data was compiled in partnership with Miller Samuel, who is a leading independent appraisal firm.

Read More5446 North Bay Road, Miami Beach. Listed for $29 Million by Brett Harris of Douglas Elliman.

Douglas Elliman Releases Q1 2017 Market Reports, Shows Continued Strong Growth Across South Florida

Douglas Elliman has released their Q1 2017 South Florida Market Reports for Miami Mainland, Miami Beach, Boca Raton, Fort Lauderdale, Palm Beach, Wellington, Delray, and Jupiter/Palm Beach Gardens. The data was compiled in partnership with Miller Samuel, who is a leading independent appraisal firm. Reports reflect price and sales trends along with current market conditions and emerging market trends. The data through Q1 2017 reflects the continued strong growth of South Florida real estate as it continues to be a destination from flight capital from both northern states and International buyers.

MIAMI BEACH/BARRIER ISLANDS HIGHLIGHTS

Key Trend Metrics (compared to same year ago period)

OVERALL MARKET

- Median sales price slipped 5.8% to $385,000

- Average sales price jumped 10.4% to $999,241

- Number of sales rose 0.6% to 815

- Days on market was 143, up from 97

- Listing discount was 12.1%, up from 8.8%

- Listing inventory increased 6.4% to 6,166

LUXURY CONDO

- Median sales price increased 14.2% to $3,025,000

- Days on market was 207, up from 119

- Listing discount was 13.1%, up from 10.1%

- Listing inventory increased 11.8% to 1,188 units

- Entry threshold began at $1,600,000

LUXURY SINGLE FAMILY

- Median sales price surged 56.5% to $11,425,000

- Days on market was 261, down from 352

- Listing discount was 20.4%, up from 12.8%

- Listing inventory fell 14.5% to 165 units

- Entry threshold began at $6,250,000

5446 North Bay Road, Miami Beach. Listed for $29 Million by Brett Harris of Douglas Elliman.

____________________________________________________________________________

MIAMI COASTAL MAINLAND HIGHLIGHTS

Key Trend Metrics (compared to same year ago period)

OVERALL MARKET

- Median sales price increased 12.5% to $292,500

- Average sales price rose 0.3% to $405,266

- Number of sales fell 2.7% to 3,487

- Days on market was 81 up from 76

- Listing discount was 5.6%, unchanged

- Listing inventory fell 19.9% to 10,186 units

LUXURY CONDO

- Median sales price fell 27.5% to $785,000

- Days on market was 154 days, up from 110

- Listing discount was 7.8%, down from 8.4%

- Listing inventory slipped 8% to 2,535

- Entry threshold began at $520,000

LUXURY SINGLE FAMILY

- Median sales price declined 12.8% to $1,200,000

- Days on market was 138 days up from 113

- Listing discount was 7.7%, up from 7%

- Listing inventory declined 15.9% to 924 units

- Entry threshold began at $825,000

____________________________________________________________________________

FORT LAUDERDALE HIGHLIGHTS

Key Trend Metrics (compared to same year ago period)

LUXURY CONDO

- Median sales price increased 5.1% to $1,112,500

- Days on market was 48, up from 45

- Listing discount was 6.8%, down from 4.3%

- Listing inventory increased 6.2% to 344

- Entry threshold began at $785,000

LUXURY SINGLE FAMILY

- Median sales price increased 13.3% to $1,950,000

- Days on market was 189, up from 150

- Listing discount was 11.2%, down from 13.6%

- Listing inventory increased 3.8% to 359 units

- Entry threshold began at $1,200,000

5446 North Bay Road, Miami Beach. Listed for $29 Million by Brett Harris of Douglas Elliman.

____________________________________________________________________________

BOCA RATON HIGHLIGHTS

Key Trend Metrics (compared to same year ago period)

LUXURY CONDO

- Median sales price slipped 3.7% to $780,000

- Days on market was 73 days, up from 101 days

- Listing discount was 7.3%, down from 7.5%

- Listing inventory increased 27.6% to 305

- Entry threshold began at $485,000

LUXURY SINGLE FAMILY

- Median sales price jumped 18.4% to $2,365,000

- Days on market was 162 days, down from 165

- Listing discount was 9.5%, up from 15%

- Listing inventory jumped 39.2% to 565

- Entry threshold began at $1,272,500

____________________________________________________________________________

DELRAY BEACH HIGHLIGHTS

Key Trend Metrics (compared to same year ago period)

LUXURY SINGLE FAMILY

- Median sales price declined 12% to $1,399,000

- Days on market was 100, down from 136

- Listing discount was 7%, down from 13.5%

- Entry threshold began at $1,125,000

LUXURY CONDO

- Median sales price jumped 19.6% to $580,000

- Days on market was 103, up from 78

- Listing discount was 5.1%, down from 5.7%

- Entry threshold began at $400,000

Grand Opening of the Douglas Elliman Delray Beach Office

____________________________________________________________________________

WELLINGTON HIGHLIGHTS

Key Trend Metrics (compared to same year ago period)

LUXURY SINGLE FAMILY

- Median sales price declined 33.3% to $1,000,000

- Days on market was 146, down from 160

- Listing discount was 15.5%, up from 12.2%

- Listing inventory increased 13.4% to 271

- Entry threshold began at $625,000

LUXURY CONDO

- Median sales price declined 28.1% to $345,000

- Days on market was 132, up from 99

- Listing discount was 5.5%, down from 6.1%

- Listing inventory declined 22% to 46

- Entry threshold began at $330,000

____________________________________________________________________________

PALM BEACH HIGHLIGHTS

Key Trend Metrics (compared to same year ago period)

LUXURY CONDO AND SINGLE FAMILY

- Median sales price dropped 29.1% to $7,475,000

- Days on market was 239, up from 74

- Listing discount was 13.2%, up from 14.4%

- Listing inventory surged 38.7% to 86

- Entry threshold began at $5,400,000

Hammock House at 3503 Banyan Circle, Coconut Grove Listed for $5.95 Million with Michael Light and Rafael Montejo of Douglas Elliman.

____________________________________________________________________________

JUPITER / PALM BEACH GARDENS HIGHLIGHTS

Key Trend Metrics (compared to same year ago period)

JUPITER SINGLE FAMILY

- Median sales price declined 5.9% to $447,000

- Days on market was 73, up from 74

- Listing discount was 5.1%, up from 6.1%

- Listing inventory increased 4.2% to 499

JUPITER CONDO

- Median sales price increased 17.7% to $282,500

- Days on market was 210, up from 201

- Listing discount was 5%, down from 5.7%

- Listing inventory increased 81.7% to 318

PALM BEACH GARDENS SINGLE FAMILY

- Median sales price increased 16% to $479,000

- Days on market was 91, up from 79

- Listing discount was 6.6%, up from 6.4%

PALM BEACH GARDENS CONDO

- Median sales price increased 4.3% to $220,000

- Days on market was 59, down from 60

- Listing discount was 5%, down from 5.3%

About Douglas Elliman:

Douglas Elliman was established in 1911 and has grown to become the largest regional and the nation's fourth largest real estate company. Douglas Elliman has a current network of more than 6,000 agents in over 80 offices throughout Manhattan, Brooklyn, Queens, Long Island (including the Hamptons and North Fork), Westchester and Putnam Counties, as well as South Florida, California, Connecticut, Colorado and New Jersey. In addition, through a strategic partnership with Knight Frank Residential, Douglas Elliman's powerful network extends to 488 offices in 59 countries. Read our PROFILE Exclusive Interview with Douglas Elliman CEO, Florida Brokerage Jay Parker.

Hammock House at 3503 Banyan Circle, Coconut Grove Listed for $5.95 Million with Michael Light and Rafael Montejo of Douglas Elliman.

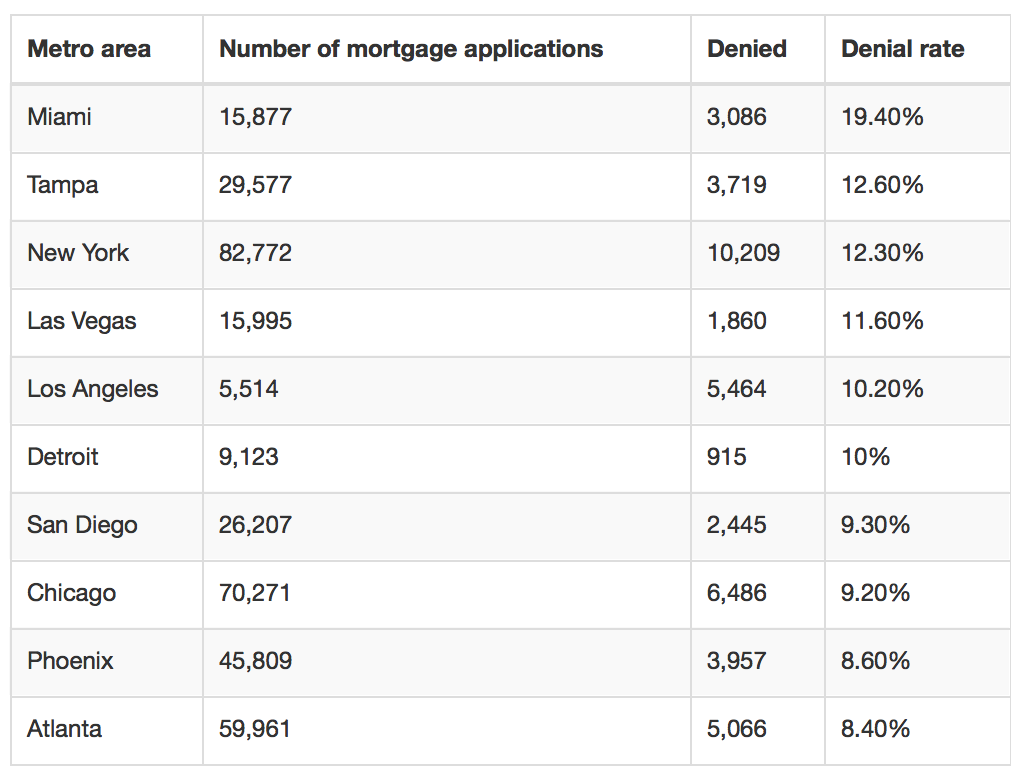

Miami Leads U.S. Cities in Mortgage Denial Rate at 19.4%

Miami has the highest mortgage denial rate amongst U.S. cities according to Case-Shiller with a 19.4% denial rate. Miami is followed by Tampa Bay, New York and Las Vegas at 12.6%, 12.3% and 11.6% respectively. In Miami 15,887 homebuyers sought a mortgage and 3,086 were denied. These numbers do not include deals in which the mortgage was not actually closed, but merely approved. According to Miami Agent Mag the actual rate of approved and funded mortgages is closer to 61.6%, meaning a denial rate around 38.4%. This looks to stand to get worse as inventory levels and prices rise. Parts of Miami are also still effected by the mortgage market collapse of 2007, and many of these properties do not meet standards for mortgage underwriting. Additionally many residents carry too much debt and/or lack collateral to qualify for a mortgage. In the condo market, a shockingly mere 13 of 9,307 condo buildings in Miami-Dade and Broward counties were approved for FHA loans.

PROFILE Exclusive: Market Update with Demetri Demascus, REALTOR® & Founder of The Demascus Group X SRG

PROFILEmiami had the exclusive opportunity to sit down with Demetri Demascus, a top-producing REALTOR at Spectrum Realty Group as well as an investor and developer in the Miami market, to get his opinion on the fast movement that the Miami real estate market has seen over the last year as well as how to how to navigate uncertain market conditions.

PM: What have you seen over the last year in the Miami real estate market?

DD: The market has been grinding to a halt. Anyone who says it isn't just really is not looking at the data. Yes there are still new projects selling, but even developers topping off their buildings are feeling the pressure from buyers still needing to close on the final 50% or so of their purchase. There are less buyers pulling the trigger; thus, less offers which is starting to pull prices down.

PM: What factors are influencing this?

DD: The world is very different than it was five years ago and many of the economic and political shifts have effected Miami's real estate market. Miami is a haven for a lot of flight capital, meaning as soon a foreign family has money, they are coming to the United States. Safety is their main priority as people escaping foreign countries are looking for safer, more stable investments. They are afraid of keeping their money in unstable economies or in countries with corrupt, unstable governments and politics.

The weakened purchasing power of foreign economies has also directly negatively affected the residential real estate market in Miami-Dade as well as the stronger U.S. dollar, which is making local markets unaffordable. Some investors are also adversely effecting real estate values as they profit off of currency fluctuation and lock in what appear to be losses in real estate for gains in currency.

PM: How do you recommend people navigate the uncertainty?

DD: With crisis comes opportunity. Yes lots of people are worried and upset about the values of their properties, which means they may be feeling the squeeze to sell. What most real estate shoppers do not realize, is that a "buyers market" is actually a bad market. You want to buy when real estate is at its lowest and sell when it is at its highest. Why not take advantage of the low pricing and some of the opportunities that are out there. People who are scared of the "market crash" or who have been effected by unstable foreign markets will sometimes sell their home quick and below market value, giving you the opportunity to cash in on deals that would not otherwise be available. Buy some properties while their value is weak so that you can profit when their value is high.

PM: Are there any neighborhoods that are exciting to work-in as the rest of the market seems to pull back?

DD: Yes, there is always excitement no matter how the economy is. Right now there is a lot going on in Park West and Coconut Grove. Park West is a fairly new neighborhood which is second after Fisher Island when it comes to average monthly rent. It is the area where Museum Park is and includes Marquis Residences, Ten Museum, 900 Biscayne and Marina Blue. This is a young, vibrant group of buildings and residents as well as will only improve as One Thousand Museum and Paramount World Center race towards completion.

Also Coconut Grove is night-to-day. This area has always had pockets of luxury, but the neighborhood got lost in time as Brickell and Miami Beach have cannibalized a lot of the market over the past twenty years. Slowly parts that have ben known as "the hood" have seen many sales close to $1 million and new construction has completely transformed the neighborhood. New restaurants, stores and high-end luxury-condo buildings have . This is surely an area that will continue to grow as it truly is one of the most lush, beautiful, neighborly communities in South Florida.

PM: Do you think South Florida and Miami real estate will continue to grow?

DD: When people look at the market right now they see two major driving factors. One is the weather and landscape. Miami is beautiful because you have the sun, sand, beach, bay, etc. There will always be a desire to live in a major city that offers such an outdoor lifestyle. The second is the attractive cost of prime real estate. No where else in the world right now can you buy such prime real estate for such discounted prices, at times near $400 SF. That is attractive to any investor no matter who you are.

Read our 2017 Market Outlook with Demetri Demascus from July 2016.

Office location: 4141 NE 2nd Ave, STE 106-B Miami FL 33137

About Demetri Demascus & The Demascus Group X SRG:

The Demascus Group X SRG was founded in 2016 to provide our clients with modern, full-service real estate experience. The Demascus Group X SRG provides each client an individualized program tailored to their needs matched with with unprecedented support. Our services range includes sales and brokerage services, investments, property management and portfolio management. We cultivate and maintain strong partnerships with the top real estate attorneys, title companies, contractors, architects, banks and mortgage brokers and give our clients full access to our network to help them succeed. Demetri Demascus has over 8 years of experience in real estate across various markets as a residential and commercial broker, real-estate developer, manager and investor. He has set record prices in Miami working with his clients. Demetri Demascus is a member of the Miami Association of REALTORS and has knowledge in the South Florida Real-Estate Market. He is also the managing partner of Trilogy Partners, a real estate investment firm. Visit Demetri & The Demascus Group X SRG at www.demetridemascusmiami.com.

Miami Falls to 10th in Average 1 Bedroom Rental Prices Amongst U.S. Cities

Miami has fallen to tenth amongst U.S. cities when it comes to most expensive one bedroom rental prices according to Zumper. According to their study Miami has an average rent of $1,800, down .6% from last month and down 3.7% from the same time last year. Two bedrooms have remained stable at $2,500 both year over year and month over month. Seattle passed Miami to 9th after seeing major growth and San Francisco ($3,380), New York ($3,000), and Boston ($2,250) remained the top three although rents in those three cities were down across the board.

Miami Named Top 20 City for Building Wealth

Miami has been named one of the top cities in the United States for building wealth. According to Bankrate, Miami residents have an average debt burden of $25,644 and a 58% home ownership rate. While the chart below shows Miami as the only ranked city with a negative ratio of savable income, Bankrate highlights that Miami was adversely effected by a high population of retirees and older residents who are spending their retirement savings. The rankings also considered average income and expenditures, unemployment rate, education, retirement plans, homeownership rates, price appreciation and non-mortgage debt. Miami continues to be a hotspot for new development and continues to attract new residents and jobs.

Median Rent Prices in Miami By Neighborhood Fall 2016

Rents in Miami continue to hold stable according to Zumper's fall 2016 rental housing report. The report reflects median rents for 1-bedroom units across 60 Miami neighborhoods. Data shows that median rents are down a bit in Edgewater, Brickell and West Avenue on Miami Beach. Essex Village and Flagler have the fastest growing rents and are both up 11% since Q2 2016. Fisher Island has the highest median rent for a 1-bedroom unit at $5,100 per month. With such a glut of new inventory hitting the market it is imperative for investors to stay current on rental prices across various neighbors over the next several quarters.

3 Most Expensive Neighborhoods:

1. Fisher Island - $5,100

2. Park West - $2,500

3. Village of Key Biscayne - $2,350

3 Cheapest Neighborhoods:

1. Brownsville - $660

2. Pinewood Park - $880

3. Liberty City/ West Little River/ Gladeview - $900

Fort Lauderdale Rents Rise & Vacancy Falls as Shortage in Rental Apartment Units Hits

Fort Lauderdale has a growing demand for rental apartments and a limited supply with only a handful of new projects about to be delivered. For Lauderdale's vacancy rate fell to 3.2% in Q3 of 2016 while rents rose 8% year over year to an average price of $1,614 per month. Some of this is driven by potential buyers being deterred from buying a house due to an expensive housing market. Brossard has a $293,200 median price for a single family home. There are currently 7,300 residential apartment units under construction in Broward expected to be delivered before 2018. 1,800 of those are are in Fort Lauderdale. Without a surplus of new units coming to the market as in Miami, rents should continue to rise and vacancy should continue to fall.

Chinese Interest & Investment in Miami Real Estate Continues to Slowly Grow

The Chinese share of the South Florida real estate market is expected to grow as Chinese investment in U.S. real estate is expected to reach $50 billion by 2025. Wealthy Chinese buyers are the top foreign buyers in the U.S. real estate market after spending over $27 billion over th past four years. Despite this, Chinese buyers represent only 2% of foreign home sales in Miami, trailing countries such as Brazil and Colombia. Miami is an attractive market for the Chinese as it is much more affordable than New York and San Francisco. They are also drawn by the stable and rising rental income in addition to the appreciation potential. Local brokers are already reporting an uptick in interest from Chinese buyers as both ISG and Cervera Real Estate have signed partnerships with Homelink International, which is one of the largest brokerages in China. Both CMC Group and OneWorld Properties have been marketing their Brickell Flatiron and Paramount Projects to Chinese buyers respectively. Additionally there has been a major push from the Great Miami Chamber of Commerce's Asia Task Force to approve nonstop flights between Miami and China. With the major push towards bringing Chinese real estate investors underway, look for an uptick in Chinese investment in South Florida to continue to grow and help pick up the slack left behind in the wake of unstable South American governments. Learn how Miami developers and agents are looking to China to boost sales from our September report.