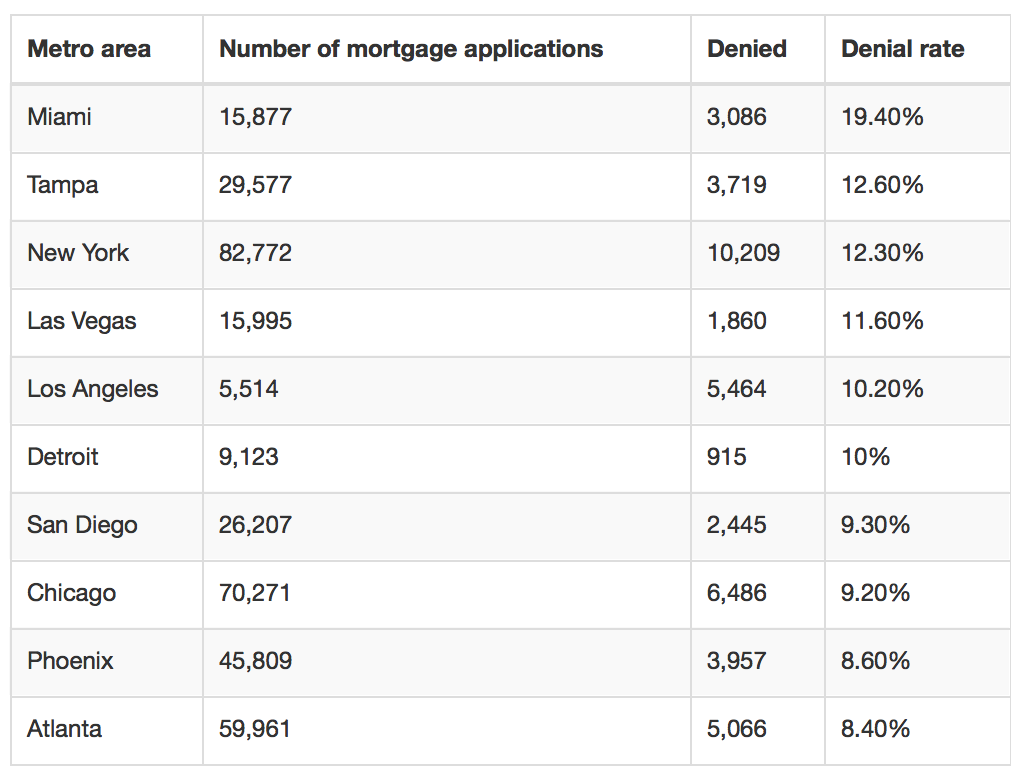

Miami has the highest mortgage denial rate amongst U.S. cities according to Case-Shiller with a 19.4% denial rate. Miami is followed by Tampa Bay, New York and Las Vegas at 12.6%, 12.3% and 11.6% respectively. In Miami 15,887 homebuyers sought a mortgage and 3,086 were denied. These numbers do not include deals in which the mortgage was not actually closed, but merely approved. According to Miami Agent Mag the actual rate of approved and funded mortgages is closer to 61.6%, meaning a denial rate around 38.4%. This looks to stand to get worse as inventory levels and prices rise. Parts of Miami are also still effected by the mortgage market collapse of 2007, and many of these properties do not meet standards for mortgage underwriting. Additionally many residents carry too much debt and/or lack collateral to qualify for a mortgage. In the condo market, a shockingly mere 13 of 9,307 condo buildings in Miami-Dade and Broward counties were approved for FHA loans.