PROFILEmiami presents a conversation around the impact that COVID-19 has, and will have, on the commercial real estate industry in South Florida. Hear first hand from some of Florida's leading real estate professionals about how they are reacting to the crisis, navigating the uncertain circumstances and preparing for future opportunities that may arise from the economic fallout.

Read MoreThomas D. Wood & Company Funds $42 Million For Windward Marina Group's Acquisition Of 3 Northeast Florida Marinas

Windward Marina Group has closed on the acquisition of three marinas in the Northeast Florida market with $42,000,000 in mortgage loan financings arranged by Thomas D. Wood and Company. Thomas D. Wood Jr. secured financing in the amount of $11,000,000 for the acquisition of St. Augustine Shipyard.

Read MoreAvison Young Completes 133,140 SF Of Industrial Leases In Broward County

Avison Young has announced it negotiated five industrial lease transactions totaling 133,140 SF in Broward County, Florida. The transactions were overseen by Avison Young Principals Tom Viscount and Wayne Schuchts.

Read MoreGalium Capitals Acquires 1333 Main Street Office Assemblage In Downtown Columbia, SC

Galium Capital, LLC, a Miami-based private equity group, has announced the acquisition of 1333 Main St. in Columbia, SC. 1333 Main St. is a premier office building and assemblage in the Downtown CBD of Columbia. The transaction closed for $29,350,000 on February 27, 2020.

Read MoreBlue Lagoon Community Gets Much-Needed Rental Development Soleste and A New Name

The Estate Companies, a leading developer of luxury multi-family projects throughout South Florida, has secured its certificate of occupancy (CO) for Soleste Blue Lagoon, a luxury, eight-story development with 330 rental units located at 5375 NW 7th Street in Miami.

The project broke ground in 2017 and move-ins began in October. Because Soleste Blue Lagoon is the only Class A market-rate project in the Blue Lagoon community, home to over 100 multinational companies, it quickly achieved 65 percent lease-up. The Blue Lagoon office community also recently announced a $10 million makeover and name change. The 250-acre office park will rebrand itself as the Waterford Business District, in order to remain competitive with Miami’s growing office market.

Tenants can select from a variety of studios, one, two and three-bedroom units outfitted with sleek, modern kitchens with custom cabinets, quartz countertops and designer lighting, dual master suites, spacious walk-in closets and private balconies overlooking Blue Lagoon Lake. Pricing starts in the $1,500’s for studios, $2,100’s for two-bedrooms, and $2,600’s for three-bedrooms.

“We are proud to deliver this transformative development to the Blue Lagoon area,” stated Robert Suris, managing principal, The Estate Companies. “Our firm is committed to developing beautiful and highly-amenitized communities at a competitive price point. This winning combination makes Soleste Blue Lagoon an attractive and dynamic option for high-quality, professional tenants.”

Like all projects within the Soleste Living brand portfolio, Soleste Blue Lagoon is curated with a vast collection of health and wellness offerings and social components, including a lakeside pool with spa, sundeck and private cabanas, co-ed spa with steam room and sauna, aerial yoga studio, state-of-the-art health and fitness club, spinning room with digital fitness instruction, rooftop garden with life-size chess, hammock and yoga lawn, and an electric car charging station.

This milestone comes on the heels of the firm’s grand opening of Soleste Twenty2, a 338-unit rental community, which is also experiencing high velocities at the current price points.

The Estate Companies is on track to deliver an additional 519 units this year with Soleste Alameda and Soleste Bay Village and has an additional 2,196 units in its pipeline slated for delivery early next year. Notable upcoming projects include Soleste Bay Village, Soleste Grand Central and Soleste Spring Gardens, among others. Its project portfolio features a mix of garden-style, mid-rise and high-rise rental developments in Dade and Broward counties.

By Katya Demina

$45 Million Trophy Office Building for the 1% Hits the Market in South of Fifth

The Yukon Miami, which commands one of the highest per square foot rents in Florida at $78 per square foot, is located at 119 Washington Avenue in Miami Beach’s affluent South of Fifth neighborhood. The Arquitectonica-designed office building has just hit the market for $45 million. Amit Egan Datwani of The Global Consulting Organization and Cyril Bijaoui of The Company Real Estate are representing the seller.

The 43,140-square-foot commercial office building is the only Class A office building located in the South of Fifth enclave steps away from world-class, record revenue breaking restaurants, including Joe’s Stone Crab, Estiatorio Milos, and Prime 112.

In addition to its prime location, The Yukon Miami features more than 8,000 square feet of available rooftop terrace space with 360-degree views of the Atlantic Ocean, Miami Beach, and Downtown Miami, the largest commercial roof and deck space in South of Fifth.

“Nestled between Fisher Island (the richest zip code in the United States) and the revitalized Washington Avenue only enhances the locational appeal of the South of Fifth neighborhood,” said Amit Egan Datwani, founder and chief consultant at The Global Consulting Organization. “The Yukon Miami is the ideal opportunity for a visionary investor that understands this and has the ability to transform the property from a trophy asset to an absolute gem.”

Premier tenants include One Sotheby’s International Realty, Red Steakhouse, W5 Group (a global real estate investment platform), and several financial companies, including Boston-based Raptor Capital Management, Manhattan-based York Capital Management, and Sero Capital.

A private launch party to promote the building hitting the market will be held on The Yukon’s rooftop terrace next month.

By Stephanie Warren

PROFILE Exclusive: Private Equity & Navigating A Changing Retail Landscape With Jacques Bessoudo of Galium Capital

Very few investors have been able to successfully navigate the changing retail and office market landscape’s as well as Galium Capital’s Managing Partner, Jacques Bessoudo. Building his firm to over $350 million of commercial assets in just two short years, Galium Capital is poised to be one of the major private equity players over the next decade in South Florida real estate.

Read MoreResidences by Armani/Casa Pays Off $315 Million Construction Loan

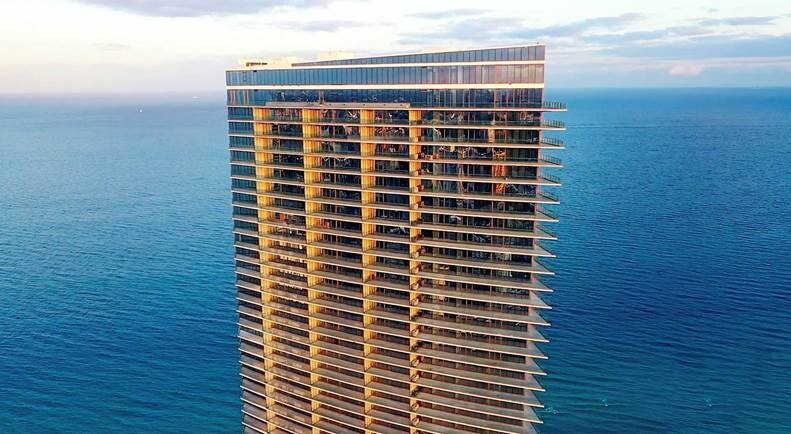

Developers The Related Group and Dezer Development announced today the payoff of a $315 million construction loan to Wells Fargo for Residences by Armani/Casa. The 308-unit tower located on the sands of Sunny Isles Beach celebrates the legendary vision of interior design firm Armani/Casa, led by the famed Giorgio Armani; architecture firm Pelli Clarke Pelli, founded by the late César Pelli.

Read MoreMoishe Mana Closes On Acquisition of Former City National Bank In Downtown Miami For $25 Million

Billionaire real estate investor Moishe Mana has closed on the $25 million sale of 25 West Flagler Street, an assemblage of three adjacent parcels totaling 29,000 SF of land in Downtown Miami’s Central Business District (CBD). The property features redevelopment potential of up to 80 stories and ±696,000 SF, as of right.

Read MoreCMC Group Pays Off $236 Million In Construction Loans For The Recently Completed Brickell Flatiron

Unit closings are underway and residents are moving in at Downtown Miami’s newly-completed Brickell Flatiron tower, with 50% of the 64-story tower’s contracts successfully closed over the last 30 days. The news comes as developer CMC Group retires $236 million in construction loans for the project.

Read More