The New York City-headquartered commercial real estate investment bank Eyzenberg & Company has expanded into Florida, opening a new office in Miami. It is the third location for Eyzenberg & Company, led by NYC dealmaker David Eyzenberg, as the firm continues to grow its capital solutions platform.

Read MoreJoin Us For a Webinar: COVID-19 Impact On Commercial Real Estate in South Florida

PROFILEmiami presents a conversation around the impact that COVID-19 has, and will have, on the commercial real estate industry in South Florida. Hear first hand from some of Florida's leading real estate professionals about how they are reacting to the crisis, navigating the uncertain circumstances and preparing for future opportunities that may arise from the economic fallout.

Read MoreThomas D. Wood & Company Funds $42 Million For Windward Marina Group's Acquisition Of 3 Northeast Florida Marinas

Windward Marina Group has closed on the acquisition of three marinas in the Northeast Florida market with $42,000,000 in mortgage loan financings arranged by Thomas D. Wood and Company. Thomas D. Wood Jr. secured financing in the amount of $11,000,000 for the acquisition of St. Augustine Shipyard.

Read MoreShoma Group Closes On $17.6 Million Construction Loan For Ten30 South Beach

South Florida developer Shoma Group has announced that they have closed on a $17.6 million construction loan for Ten30 South Beach. The loan was provided by New York-based ACRES Capital Corp.

Read MoreEast End Capital & Related Group Secure $136 Million In Refinancing For Wynwood 25 & Wynwood Annex

Partners East End Capital and The Related Group closed on $136 million in financing for its a master-planned, mixed-use developments Wynwood 25 and Wynwood Annex. The financing was provided by Blackstone Real Estate Debt Strategies and is being used to fully satisfy the construction loans for both projects and return equity to the partners. Completed in June 2019, the nine-story building is already nearly 90% leased.

Read MoreTerra, New Valley, Great Eagle Holdings and Bizzi & Partners Pay Off $155 Million Construction Loan For Eighty Seven Park

The partners behind Eighty Seven Park, Pritzker Prize winning architect Renzo Piano’s first residential development in the United States, have paid off $155 million in construction financing for the newly-completed Miami Beach condominium tower.

Read More13th Floor Investments & Adler Group Lock Down $99 Million In Construction Financing For 2nd Tower At Link at Douglas

Miami-based real estate developers Adler Group and 13th Floor Investments have finalized a $99 million loan that will open the door to the construction of a second tower at Link at Douglas, a 7-acre master-planned development that will transform Miami-Dade County’s Douglas Road Metrorail Station into a mixed-use transit hub with residential, retail and commercial office uses.

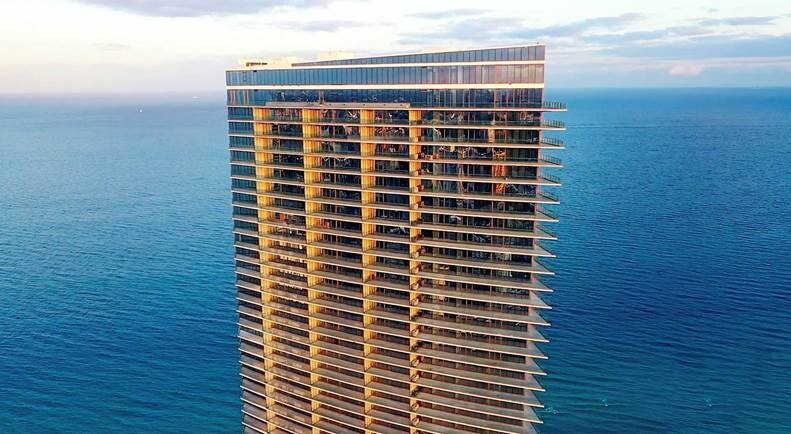

Read MoreResidences by Armani/Casa Pays Off $315 Million Construction Loan

Developers The Related Group and Dezer Development announced today the payoff of a $315 million construction loan to Wells Fargo for Residences by Armani/Casa. The 308-unit tower located on the sands of Sunny Isles Beach celebrates the legendary vision of interior design firm Armani/Casa, led by the famed Giorgio Armani; architecture firm Pelli Clarke Pelli, founded by the late César Pelli.

Read MoreCMC Group Pays Off $236 Million In Construction Loans For The Recently Completed Brickell Flatiron

Unit closings are underway and residents are moving in at Downtown Miami’s newly-completed Brickell Flatiron tower, with 50% of the 64-story tower’s contracts successfully closed over the last 30 days. The news comes as developer CMC Group retires $236 million in construction loans for the project.

Read MoreAztec Group Arranges $142 Million In Debt Financing For Melo Group's Art Plaza

Aztec Group, Inc., Florida’s leading real estate investment and merchant banking firm for the past 38 years, announces that Peter Mekras, President of Aztec Group, has arranged $142 million in debt financing for Art Plaza in Miami, Florida, consisting of 667 rental apartments and 15,000 SF of retail space. This is the 10th loan Mekras has placed for Melo Group.

Read More