Jimmy Tate and Tate Capital has locked in a $50 million loan for Bahia Mar in Fort Lauderdale Beach from Florida Community Bank and has boosted its mortgage on the property to $135 million. The project includes a $7 million redesign of the Bahia Mar Fort Lauderdale Beach – a DoubleTree by Hilton, which is a 40-acre, 296-key resort. Bahia Mar was redesigned by Kobi Karp and is expected to be completed in October (2017). Tate Capital is planning to invest close to $500 million in redeveloping the property into a mixed-use project which will also include 7 apartment buildings, dock space, restaurants, a 250-slip marina with docking for 100 mega-yachts, etc. They have also secured that the Fort Lauderdale International Boat Show will remain at Bahia Mar through 2050.

Terra, New Valley, Great Eagle Holdings and Bizzi & Partners Secure $155 Million In Construction Financing for Eighty Seven Park, Prepare to Commence Vertical Construction

Terra, New Valley, Great Eagle Holdings and Bizzi & Partners, the partners behind Eighty Seven Park, Renzo Piano’s first residential project in the U.S., have finalized a construction loan that will open the door to vertical construction. The loan is for $155 million in construction financing from United Overseas Bank. Terra has reported that the building is now over 60% sold with a sales volume of over $250 million. The start of vertical construction follows initial site work that involved placing 300 foundation pilings into the ground.

“Local and international buyers are responding to Eighty Seven Park’s brand of intelligent luxury, with more than sixty percent of our sixty-six units now sold,” says Terra president and co-founder David Martin. “Eighty Seven Park’s singular location, combined with Renzo Piano’s sophisticated design and the equity we’ve built through pre-construction sales, have created a powerful combination that put us in position to secure construction financing.”

“Buyers seeking oceanfront living in Miami Beach have many options, and Eighty Seven Park is the most desirable among them as evidenced by our sales success,” says Howard M. Lorber, chairman of Douglas Elliman Real Estate and CEO of Vector Group, the parent company of New Valley. “Our project offers the amenities, exclusivity and sophisticated design that today’s most discerning buyers are looking for.”

“IRR Miami’s market forecasts indicate that the only new projects that will get started over the next 24 months are those sponsored by the strongest developers,” explains Anthony Graziano, chairman of Integra Realty Resources and senior managing director for IRR-Miami/Palm Beach. “The strength of Eighty Seven Park lies in its location, design, and the experience of the development team that Terra has assembled. This is another example of Terra’s ability to deliver bold projects in irreplaceable locations.”

Eighty Seven Park is located on Collins Avenue in North Beach at 87th St. and Collins, which is the northern-most parcel of land in Miami Beach. Eighty Seven Park will be an 18 story glass tower with expansive, unobstructed views of the Atlantic Ocean, Miami Beach and Biscayne Bay. The building was designed by famed designer and Pritzker Prize-winning architect Renzo Piano Building Workshop in collaboration with RDAI, West 8 designed the landscape architecture and Ruben and Isabel Toledo will handle branding and marketing material. Eighty Seven Park will feature 68 residences that range from 1 to 5 bedroom layout and 1,400 SF to over 7,000 SF. Pricing ranges from $1.6 million to $15.2 million. There will also be a full-time concierge and butler service, smart home and building technology and five-star amenities including a salon, resort style pool with full-service bar, valet, security, library and on-site enoteca complete with on-site wine tasting. Eighty Seven Park is expected to be completed in 2018.

Midtown Continues to Expand as Magellan Development Closes on $110 Million Construction Loan for Midtown 6

Midtown Miami is continuing to expand as Magellan Development Group and an entity linked to Alex Vadia has closed on a $110 million construction loan for the proposed rental tower. The project, which is now ready to break ground, will rise 32 stories and was designed by BKL Architecture. Midtown 6 will feature 447 rental apartment units, 601 parking spaces and 40,000 SF of ground floor retail. Magellan also devleoped Midtown 5 which opened earlier this year as well as has proposed Midtown 7.

Mast Capital + Angelo, Gordon & Co. Purchase Conrad Miami for $72 Million

Mast Capital, a Miami-based investment and development firm, and Angelo, Gordon & Co. have purchased the Conrad Miami from Holborn LC for $72 million. They will operate the hotel as a joint venture and have agreed with HEI Hotels & Resorts to enter the first Conrad Hotels & Resorts franchise agreement within the United States. The flagship Conrad Miami is located with the iconic Brickell Arch Tower. The interest purchased includes 203 hotel keys, a rooftop amenity deck, and a condo-hotel rental program, which currently has 41 out of 116 residential units participating. The Brickell Arch Tower contains 267,000 SF of rentable Class A office, 203 hotel keys, and 116 luxury residential units.

“This property was extremely compelling because of its prominent location on Brickell Avenue and world class architectural design,” said Camilo Miguel Jr., CEO of Mast Capital. “It is exciting to have the opportunity to fully realize the potential of the property. We are confident that the Conrad brand’s concept of smart luxury will be favored by guests and residents for years to come.”

The transaction was facilitated by Christian Charre, Paul Weimer and Natalie Castillo of CBRE Hotels. Mast Capital was represented by Kimberly LeCompte (acquisition), Joel Maser (corporate), Iris Escarra (zoning), Nancy Lash (loan), Nelson Migdal (hospitality) Andrew Sharpe (acquisition) and Brian Dombrowski (zoning) from Greenberg Traurig’s Miami, Washington D.C. and Fort Lauderdale offices. Lauren Giovannone and Michael Bradford from Paul Hastings’ Los Angeles office acted as co-counsel with Greenberg Traurig. The seller was represented by Suzanne Amaducci-Adams and Alexander Roitman (disposition) from Bilzin Sumberg Baena Price & Axelrod LLP’s Miami office.

Construction Update: The Related Group & East End Capital Close on $58 Million Construction Loan & Breaks Ground on Wynwood 25

After closing a $58 million construction loan from Bank of the Ozarks, The Related Group and East End Capital have broken ground on Wynwood 25, the area's first major residential project to be built under the 2015 Neighborhood Revitalization District plan's zoning changes. Wynwood 25 is slated to bring 289 rental apartments, a host of embedded amenities, 31,000 square feet of retail and 340 parking spaces to Wynwood. The efficiently-sized units are designed to add desperately-needed reasonably priced living options to the city’s most creative and artistic neighborhood. Projected to rent for under $2,000 per month. East End Capital announced in May that The Related Group has acquired a 50% partnership interest in its Wynwood 25 project and they both co-control the development.

"Projects like Wynwood 25 are key for the neighborhood to reach its full potential. Wynwood already has some of the city's favorite restaurants, coffee shops and other designations, but we saw a huge demand for urban living options. People have fallen in love with the neighborhood's unique, walkable culture and now it can be their permanent lifestyle. We look forward to setting the stand for all future projects in the area and delivering a project that complements the vibrant and walkable Wynwood Arts District," said Jon Paul Perez, Vice President, The Related Group.

“We are extremely proud to partner with The Related Group, who bring unparalleled development expertise to the endeavor,” said Jonathon Yormak, founder of East End Capital. “More importantly, Related shares our commitment to Wynwood and building a project that contributes to the existing fabric of the community.”

Floorplans will come in studio and one bedroom layouts. Units will feature 10' to 12’ ceilings, luxurious kitchens and bathrooms, and full-sized washer/dryers. Amenities will include a large state-of-the-art fitness center with yoga studio, collaborative work-from-home spaces, a coffee lounge opening onto the building’s 12,000 square foot green courtyard, bike storage, package storage, and dog wash facilities. It will also feature a landscaped roof terrace that includes a pool, barbeque, movie screen, outdoor and covered work areas, and green areas from which to take in the best views in Wynwood. Substantial art programming will be integrated into the building exterior, the paseo and the building interiors, creating a distinctive living experience.

"The vision behind creating the masterpiece of Wynwood 25 was to design a project that truly enhances the creative neighborhood of Wynwood. The Wynwood community is always evolving. Out goal was to create a project that has a sleek and modern design to become an iconic building in this thriving, vibrant community," said Kobi Karp, founder and Principal of Kobi Karp Architecture and Interior Design, Inc.

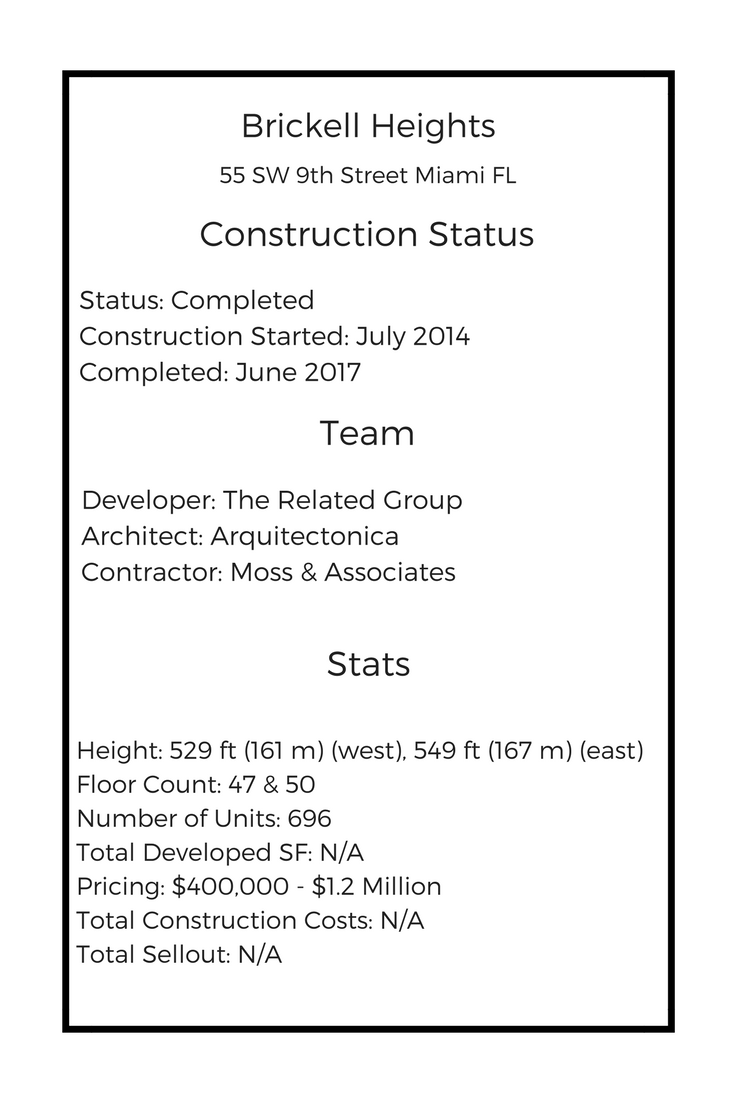

The Related Group Pays off $160 Million Construction Loan for Brickell Heights Less Than 60 Days After Project Opening

The Related Group has paid off a $160 million construction loan for Brickell Heights less than 60 days after the grand opening of the project. The twin tower, 690-unit towers were 100% sold out and are already nearly 50% closed since the June 7 opening (2017). The $160 million loan was issued by Wells Fargo Bank in April 2015 and is The Related Group’s second loan pay-off in the last year.

“The speed at which we paid off this loan is further validation of our effort to finance these projects in a responsible manner,” said Ben Gerber, Vice President of Finance for The Related Group. “It also speaks to the strength of the Related brand and the South Florida condo market as a whole.”

“Closing is easy after buyers see that today’s Brickell matches up to what they saw in renderings a few years ago. They bought into a walkable, metropolitan downtown lifestyle, and now they’re excited to start living it. We look forward to delivering SLS LUX in the winter and completing our vision for South Miami Avenue.” said Carlos Rosso, President of The Condominium Development Division of The Related Group.

The 47-and 49-story towers were designed by globally acclaimed architectural firm Arquitectonica and interiors by David Rockwell of the Rockwell Group. Amenities include a state-of-the-art fitness center, men's & women's spas, each building has a lounge room, curated art throughout, 4 swimming pools and a garden. The property will also feature a 30,000 SF Equinox Club, as well as a 6,000 SF SoulCycle studio. Brickell Heights marks the third Related Group project to open on South Miami Avenue, following SLS Brickell Hotel & Residences and 1100 Millecento. Photos via TAMZ.

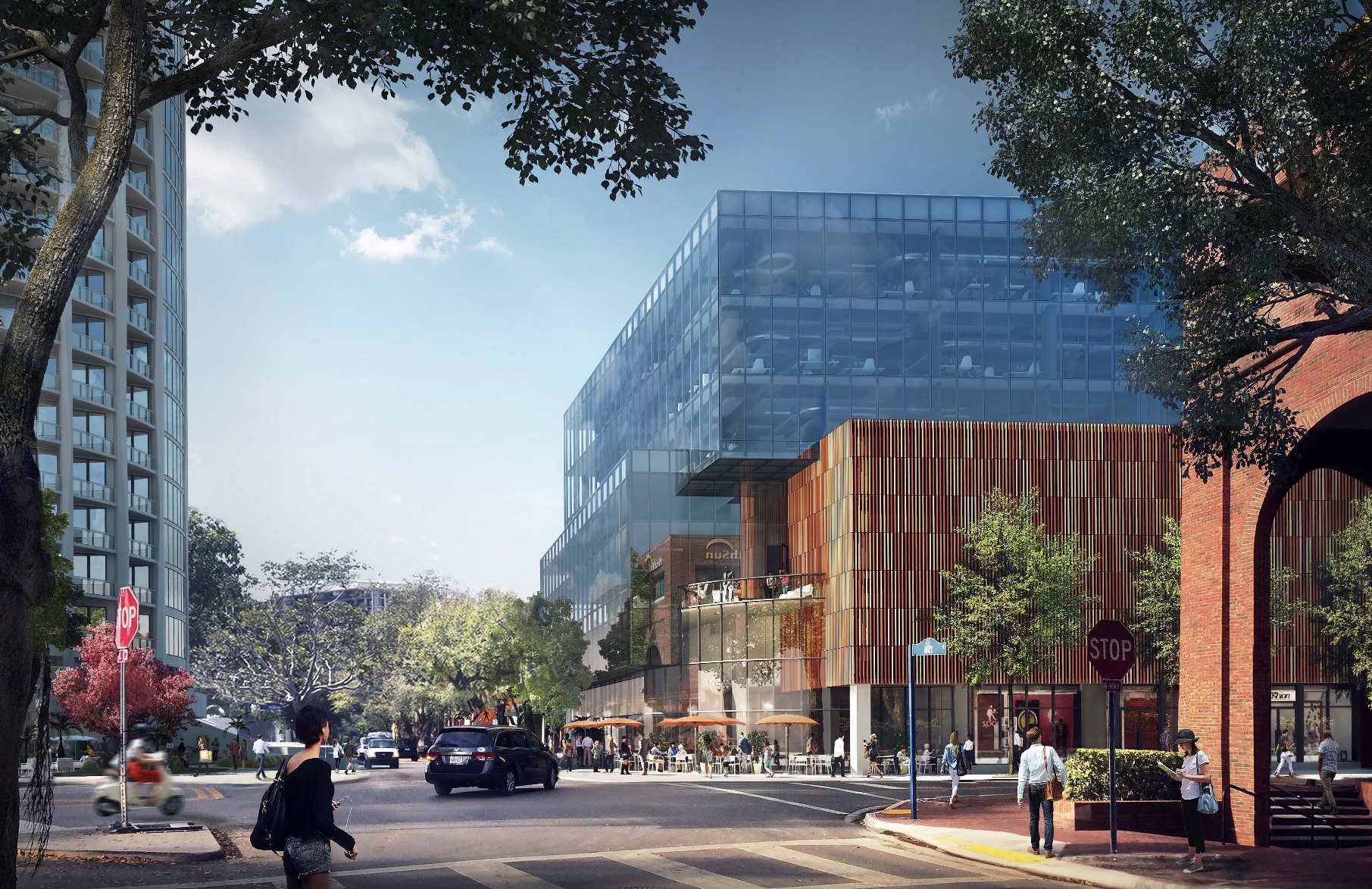

Terra Closes on $32 Million Construction Loan, To Break Ground on Mary Street Office Complex in Coconut Grove

Following the successful closing of $32 million in financing from BB&T Bank, a partnership led by Miami-based Terra will break ground on construction next month at Mary Street, a new Class A office and retail complex in Miami’s Coconut Grove neighborhood. The Touzet Studio-designed project will transform a parking garage into 78,000 square feet of contemporary Class A office space with 18,000 square feet of retail space, while preserving public parking use. The mixed-use Mary Street office complex is the latest example of 'adaptive reuse' infill development in Miami. Construction is expected to begin in early August 2017 and be completed in late 2018. Mary Street is being developed in partnership with Mayfair Real Estate Advisors, and will mark the first delivery of new Class A office space in Coconut Grove in more than 20 years, following the completion of Terra's new Grove at Grand Bay condominium two blocks away. Mary Street, Grove at Grand Bay and Park Grove, a nearby three-tower luxury residential complex being developed by affiliates of Terra, represent a new wave of design-driven urban infill development reflecting Coconut Grove’s strong residential demographics and allure as one of South Florida's most walkable and self-contained urban neighborhoods.

Mary Street's Touzet Studio design will feature a terracotta brise soleil whose vertical patterns mirror the contours of a seashell, with transformed retail storefronts that will enhance visibility and accessibility from the street. The building’s amenities include a state-of-the-art main lobby, 24-hour security, ample above ground public and office parking, covered valet and drop-off, and dedicated elevators with direct office access. Electric car charging stations, bicycle stations and bicycle storage will be available for employees, owners and guests who travel by eco-friendly means. The development’s revamped retail, which will include prime street-level frontage along Mary, Oak and Rice Streets, will cater to chef-driven restaurants with café seating and unique retail serving Coconut Grove’s residents, visitors and daytime workforce. The retail component will connect the luxury residential corridor along South Bayshore Drive with the neighborhood’s urban heart concentrated along Grand Avenue and Main Highway.

“Our ability to secure favorable construction financing for Mary Street speaks to the promising office market dynamics in Coconut Grove, the project's superior location, and the surge of interest we've received among prospective tenants within months of unveiling our plans,” said David Martin, president and co-founder of Terra.

Fortune International Group & Rialto Announce Launch of Vaster Capital to Help Foreign Nationals Close on Pre-Construction Condo Units

Fortune International Group & Rialto have announced the launch of Vaster Capital, a private bridge lender specializing in residential and commercial real estate. The goal of the company will be to fill a void in the marketplace for South Florida real estate investors seeking bridge loan products, including foreign nationals. Vaster Capital will have a major impact helping foreign nationals close on pre-construction condo units in which they are in with a 50% deposit. Fortune International Group (Fortune) is a Miami based real estate development company behind iconic towers such as Jade Signature, The Ritz-Carlton Residences, Sunny Isles Beach, and Auberge Beach Residences and Spa Fort Lauderdale; Rialto Capital Management is a Miami based real estate investment and asset management firm, which invests and manages assets throughout the capital structure in real estate properties, loans and securities, boasts a deep-rooted background in institutional lending and financial services. Vaster Capital has the ability to close loans much faster when compared to other lenders due to less bureaucracy and the use of technology. The firm plans to lend a substantial amount of capital in South Florida, with a goal to expand geographically in the near future. Vaster Capital has also formed a joint-venture with the Related Group, known as Vaster Capital II, to provide financing for buyers purchasing at Related’s portfolio of projects such as Paraiso Bay, Brickell Heights, Hyde Midtown, and SLS Lux.

“Our goal has been to satisfy a long-standing gap within our marketplace, providing professional and customized bridge lending products while better servicing the Miami real estate investor,” said Edgardo Defortuna, President and CEO of Fortune International Group & founder of Vaster Capital. “This is a need I have always sought to address, appreciating that numerous buyers – both in the U.S. and beyond -- are interested in buying and selling real estate offerings in Miami, but do not have access to customized loan offerings that meet their specific needs.”

“Given both Rialto and Fortune’s knowledge of the real estate industry, along with Rialto’s extensive experience in real estate lending, Vaster Capital is structured to become an important lender in South Florida as well as other key markets, allowing borrowers to accomplish their financing needs through a seamless and efficient process,” said Eric Feder, Vice Chairman of Rialto Capital Management.

Foreclosures and Delinquencies Down in Miami-Dade in June 2016

The foreclosure rate in Miami has fallen yet again in Miami by 1.23% in June to 2.39% according to The Real Deal and CoreLogic. The number is still double the national average which is around 1.2%. Delinquencies were also reported to be down as only 6.36% of home mortgages in Miami-Dade were over 90 days past due in June, down from around 9% last year. This should single some stability in the market as opposed to past Miami real estate cycles.