The Real Deal is reporting that spurred by dropping rents back home, Brazilian real estate investors are beginning once again to focus their sights on Miami. Rents in Miami have stayed mostly stable despite the influx of new inventory that has begun to hit the market. In Brazil rents have dropped 5.2%. The investors are looking for an escape from the political and economic instability in Brazil. Brazil had fallen out of the top five countries with interest in Miami real estate in June after 17 consecutive months at the top, but has climbed back to third in July according to the Miami Association of Realtors. Bloomberg is reporting that TRX Residential, a Miammi-base real estate investment firm, wants Brazilian investors to commit close to $30 million dollars, helping them to double the funds size. Brazilians single handedly saved the Miami real estate market in 2012 when they came to purchase second homes and take advantage of a stronger currency compared to the dollar. Since then many economic and political factors have shifted the Brazilians demand for American real estate, where they focus on Miami due to proximity, stability and potential for growth.

Miami Luxury Condo Sales Over $1 Million Reportedly Down 44.5%

Residential condo sales are reportedly down close to 21% over the same time last year in 2015, according to Mansion Global. When focusing on properties over $1 million, there were just 73 single-family home sales in July, down 31.8% from the same time in 2015. Luxury Condos saw a total of just 45 transactions in July, those numbers were down 44.4% year over year. Condos also saw average days on market up 1.9% to 162 days before sale. There are also only 1,272 pending sales, down 25.4% year over year and inventory is up 47.8% with 2,482 luxury condo units over $1 million on the market. The slowdown can be attributed to unstable governments and currencies in South America and a strong dollar, which has put a slowdown on foreign investment. It also can be tied to the slowdown that has also hit the rest of the United States over the same time period. Despite the slowdown, investors have seen this as an opportunity to take advantage of some of the deals that have come about due to the market shift.

Miami New Construction Continues To Show Strength

Although we are approaching the end of this development cycle, the Miami new construction market continued to show strength through 2016. Dodge Data & Analytics is reporting that in July Miami saw over $854 million spent on new construction, down about 18% year-over-year. That also brings Miami to about $4.218 billion spent on new construction in 2016, up 1% year-over-year. This new construction has been sparked by healthy sales, as developers must presell 80% of the project to break ground, which should help support stability in the market as over 14,700 units are under construction with over 30,000 in the planning and pre-sales phase.

Miami Comes in as 280th Most Attractive U.S. Real Estate Market

Miami has ranked as the 280th city in the United States when it comes to the attractiveness of the real estate market. According to WalletHub, out of a survey of 300 cities considering sixteen categories including Foreclosure Rate and Average Number of Days on Market, in which Miami ranked 268th and 277th respectively. Miami came in 253 when it came to Population Growth Rate, 221st in Homes with Negative Equity, 279th in Number of Unsold Homes Owned by Banks, 246th in % of Mortgage Holders in Delinquency, and 211th in Unemployment Rate. Miami's rank amongst large cities was around 58. Seven of the top ten cities were from Texas and Miami trailed Florida neighbors including Davie, Boca Raton, Pembroke Pines. These numbers show that despite the growth Miami has seen in recent years there is still a ways to go when it comes to poverty in the city.

Foreclosures and Delinquencies Down in Miami-Dade in June 2016

The foreclosure rate in Miami has fallen yet again in Miami by 1.23% in June to 2.39% according to The Real Deal and CoreLogic. The number is still double the national average which is around 1.2%. Delinquencies were also reported to be down as only 6.36% of home mortgages in Miami-Dade were over 90 days past due in June, down from around 9% last year. This should single some stability in the market as opposed to past Miami real estate cycles.

Colombia No. 1 Country with Interest in South Florida Real Estate June 2016

Colombia has once again been named the country showing the most interest in South Florida real estate according to the Miami Association of REALTORS. June marked the 7th consecutive month that Colombia led as interest has shifted from Brazil which had single handedly saved the Miami real estate market over the last 8 years. Colombia is closely followed by Venezuela, Brazil and Argentina, although unstable governments and currencies have somewhat stunted investment from those countries over the past few months. Brazil has though since recovered to the 3rd spot after dropping to 5th earlier this year. Brazil had previously been the country with the most interest for 17 months. Colombians accounted for 10% of all residential home sales in South Florida to foreign nationals in 2015 with an average price of $516,000, a number only eclipsed by Venezuela (13%) and Brazil (12%). There has also been a resurgence of Canadian buyers as developers have begun to market their preconstruciton projects to Canada. The data was gathered by analyzing foreign nationals internet searches for properties and ranked.

Miami Association of REALTORS Top 10 Countries Interested in South Florida Real Estate June 2016

- Colombia

- Venezuela

- Brazil

- Argentina

- Canada

- Spain

- India

- France

- United Kingdom

- Philippines

Zumper Reports Only 43% of Miami Residents Can Qualify For & Afford Mortgage

According to Zumper, an astonishingly low 43% of Miami residents can be approved for and afford a mortgage. Miami trails major cities including New York, Chicago, Dallas, Boston and Atlanta amongst others. Of the 15 major cities surveyed, Miami only beat San Diego, Los Angeles and San Francisco. Zumper conducted the survey amongst its user base. The state of Florida's high rate of unemployment reflects residents ability to own a home, as the survey also showed 93% of residents would like to own a home. The Miami real estate market continues to be driven by out-of-town buyers.

Miami 8th Most Expensive City to Rent in the United States

Zumper has analyzed over 1 million active listings across the United States and Miami is the 8th most expensive city to rent in the United States. The media for a 1 bedroom apartment is $1,870 per month down .53% from last year and a 2 bedroom at $2,150 down 1.57% from last year. San Francisco led the list with a median monthly rent of $3,460 for a 1 bedroom and $4,790 for a 2 bedroom. New York, Boston and San Jose trailed at $3,200, $2,230 and $2,220 respectively. With an oversupply of units about to hit the market it will be interesting to see how the Miami rental market is effected over the next year.

Miami Median Listing Price Down

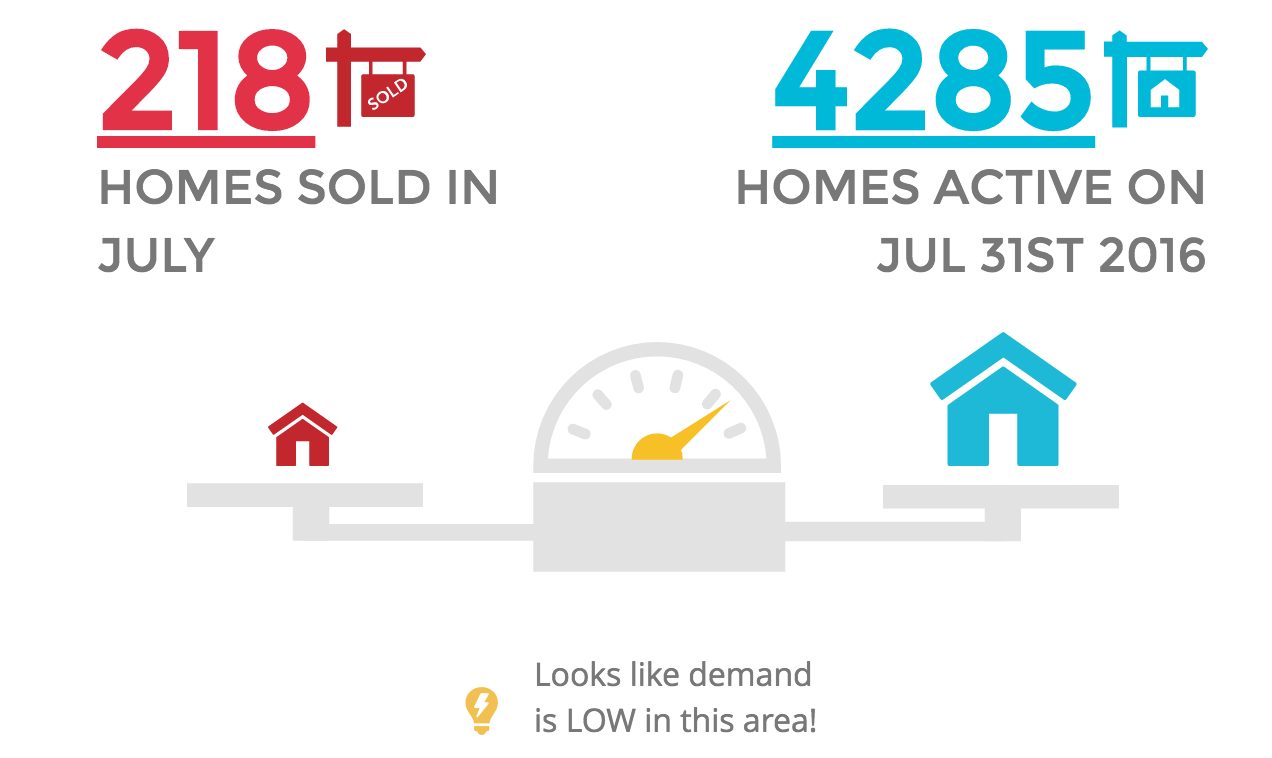

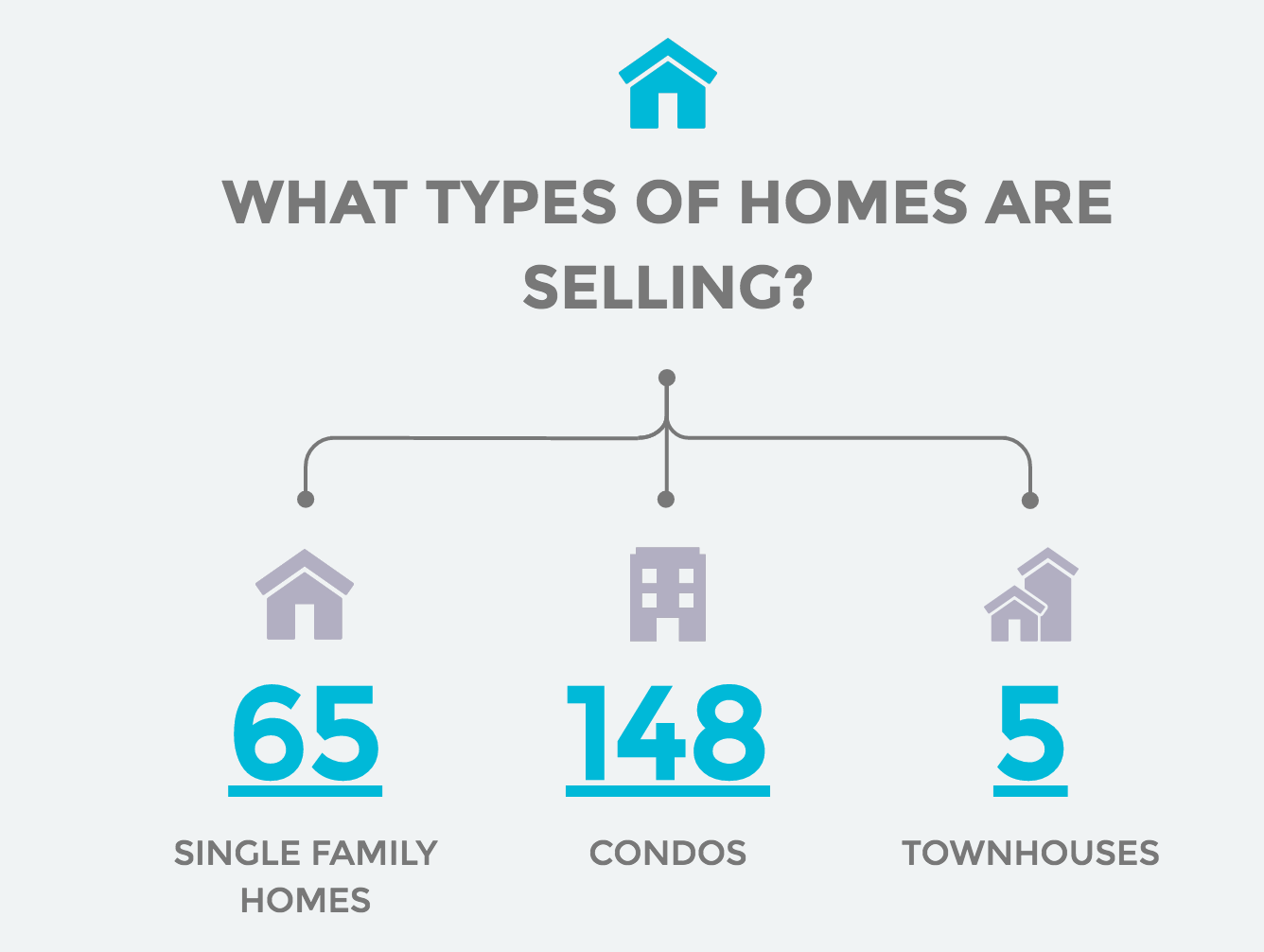

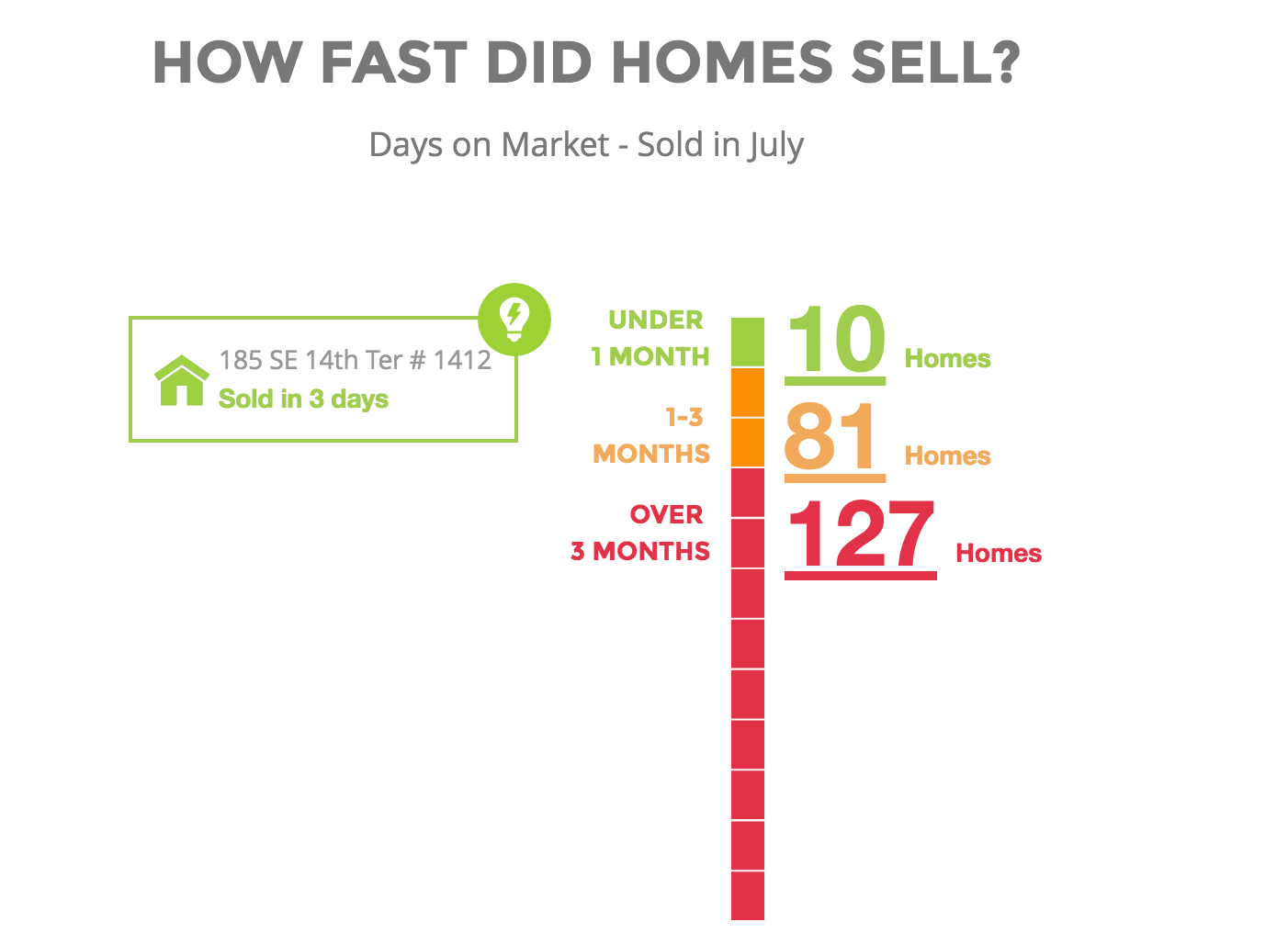

There is still debate as to the demand for homes in the Miami real estate market. Luxury homes are still moving well, with high-priced listings and closed sales all over Miami and Miami Beach. The uniquness of homes also has kept their demand and pricing fairly stable as the condo market has recently hit a bit of a snag with currency fluctuations across many of Miami's feeding South American markets. According to a report by The Open House, the median listing price is down due to a slight shift in a demand. Only 218 homes sold by July 31 with median listing price down $9,000 to $435,000. Of that only 65 were single-family homes and 5 townhomes. Only 173 paid asking price and 15 paid above asking price. 127 of the homes sold after 90 days on the market and 10 sold in under 30 with the median listing of 112 days to close. Despite this, as an oversupply of condos come on the market, single-family homes and townhomes should hold value well compared to their condo counterparts.

*The Open House

2017 Outlook with Demetri Demascus, Spectrum Realty Group

Current Status: BUY (Oversupply = opportunity for investors)

It shouldn’t be news to anyone that Miami’s real estate economy has failed to break free from it’s reliance on foreign investment. After all, the market is a melting pot of international developers who bring their newest design ideas to Miami to implement, test and refine before heading to other markets. The current development cycle led to a condo boom starting from early 2011 and Brazillian buyers poured into Miami to take advantage of exchange rates and the security of American assets. It should be no surprise that the Miami condo market is largely effected by the changing economic and political landscape in Brazil. As Brazil fell deep into turmoil in early 2016, the Miami real estate market stepped back to asses. How should investors play the market as we close in on Q4 2016?

Supply & The Developers:

South Florida currently has a 14-month supply, with a 6-month supply traditionally seen as the equilibrium. At this midway point in 2016, developers have completed 63 new condo towers, totaling over 4,900 units in Downtown Miami. 130 new buildings are currently under construction with 14,700 new units and another 221 condo buildings with 31,200 units are in the planning and pre-sale phase of development. As the market has seen a softening in early 2016, there have been at least 6 cancelled projects in Downtown Miami including Krystal Tower and Ion East Edgewater.

Developers see the current cycle to be more stable than the 2004-2008 cycle which was spurred by easy financing and quick rising prices. Today buyers must put 50% cash down and developers do not start a project until it is 80% sold so that deposits can cover a large portion of construction costs. Developers are lowering their pricing for projects in planning and pre-sale phase to spur demand and make the units more attractive to potential buyers, lowering risk.

Demand & The Consumer:

Sales velocity has fallen by considerable amounts, influenced by a mix of over-supply and weakening foreign currencies. A strong U.S. dollar, dropping oil prices and an uncertain global economic outlook has caused foreign investors to hit the brakes. Many of these factors have effected not only Miami, but also other top luxury real estate markets such as New York and Los Angeles. The Brazilian REAL has dropped over 42% compared to the U.S. Dollar, as has the Argentine Peso. Additionally, new laws targeting money launderers will negatively influence local real estate as the international community cracks down.

As South American buyers slow, a new group has visibly come out of the woodwork. There has been a significant increase in demand from New Yorkers and Chinese buyers who have began taking advantage of softening prices and investment opportunity. REALTORS have identified an opportunity to penetrate these wealthy markets that have historically not been amongst the driving force of the Miami Real Estate economy. While these buyers will not completely replace the loss of buyers from South America, it creates diversity in the market place and hedges against the loss of South American buyers. .

Outlook:

Miami is the number one destination for Millennials looking to move. Plain and simple, Miami is a city for the future. If the last 5 years of commercial development has proven anything, it’s that Miami is evolving into a world-class metropolis. Most of the condos built between 2004 and today never had a chance to appreciate. Downtown Miami, Edgewater, and until recently, Brickell, were plagued with nowhere to walk, nothing accessible, no public transportation and neighborhoods overrun with poverty and homeless. In the last year, this has completely changed as “city centers” such as Brickell City Centre, Design District, Midtown, etc. have developed into places that people desire to spend time. Miami is now a full city, and not just a place on the water with a hospitality, cruise and party industry. It stands to say that the demand for Millennials to live in Miami will not be stopping soon, giving investors a great opportunity because even if Millennials can’t afford to buy, they will still need to rent to live.

Financially, with low debt levels amongst buyers and developers alike, the Miami Real Estate Market is in much better position to sustain itself opposed to the 2008 crash. As we see more developers cancel undersubscribed projects and supply begin to correct itself, prices and sales velocity should begin to stabilize. With high demand to live in Miami mixed with an oversupply of inventory from the last development cycle and weak foreign markets, now is the time to buy in Miami. The market softening has opened up tons of opportunity across all markets of Miami. Whether you are interested in purchasing a condo for any use, multi-family rental property, or luxury-waterfront estate, now is the time to keep your eyes open for deals.