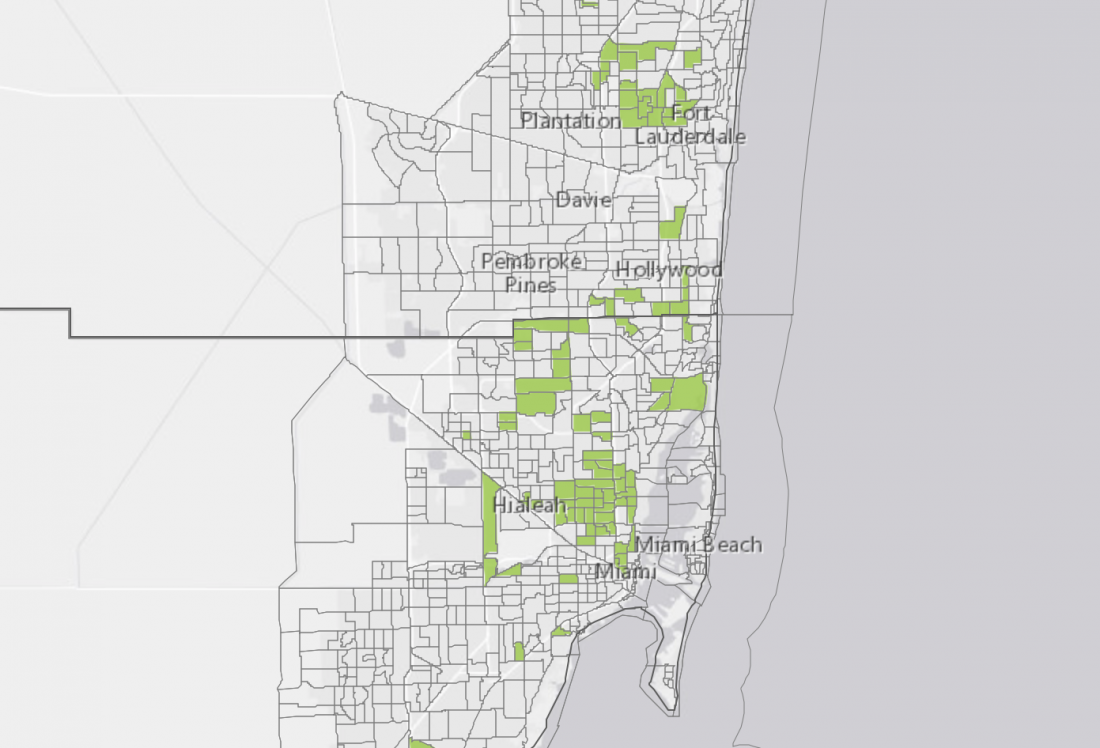

The opportunity zone program is a little-known provision of the Tax Cuts and Jobs Act that could be a powerful economic development tool for designated low-income communities. The program provides tax incentives to developers who invest in these areas, including 427 tracts of land in Florida, 68 of which are in Miami-Dade County. From a policy perspective, it was designed to connect new sources of capital to neighborhoods that haven’t realized economic growth in years.

The provision allows unrealized capital gains from prior investments - including other asset classes like stocks and securities - to be rolled into an opportunity fund to defer taxation. An opportunity fund is created in the private sector and is the first community investment tax incentive vehicle introduced since the Clinton Administration. The notion behind opportunity zones is that the longer the investment is held, the lower the tax burden is. So long as 90% of the investment remains in the community, the capital gains tax is reduced by:

10% if the investment is held for five years, or

15% if the investment is held for seven years

Fully exempt if the investment is held for at least ten years

This is an innovative advance for investors to redirect their capital to support low-income communities like Little Haiti with underappreciated value. It’s a generous incentive compared to previous economic development programs because there is no government intermediary to approve projects. Now the question of intent remains: will investment spillover enough into these neighborhoods or will this just be a chance for developers and investors to cash in?

Germaine Smith-Baugh, CEO and President of Broward County’s Urban League, worries that despite the potential for growth, with investment comes a pattern of gentrification. As property values, rents, and taxes rise, longtime residents can get priced out. “I’m right here on Sistrunk Boulevard,” an economically distressed neighborhood in Fort Lauderdale, said Smith-Baugh. “Folks are buying left and right. The foreign dollars coming in to purchase here — it’s unreal.”

Smith-Baugh hopes the program doesn’t displace local business and residents, and says the solution is to attract the right kind of impact investors, or people who will work with the neighborhoods to create workforce housing and transit. “We would like to see organizations that can aggregate potential projects and make the residents and businesses feel as though they are part of the process,” she said.

In order to qualify, the real estate asset would need to be built or be converted with improvements totaling at least the purchase price of the property. It must also be an active conduct business, meaning the asset can’t simply be a home that appreciates in value over time.

The opportunity zone program is an attractive vehicle for moving capital of scale into low-income neighborhoods with enough parameters to ensure it is being deployed toward economically productive investments that ultimately create jobs and businesses.

Map showing opportunity zones in green.

Article by: Katya Demina